As the global shift towards renewable energy gains momentum, there is a pressing need for a more flexible, agile power grid, which can quickly respond to shifts in supply and demand. But this is more than just a physical infrastructure problem – it’s a data puzzle, too.

Modo Energy wants to solve it.

The energy storage problem

While sources like solar and wind are less carbon-intensive, they have an intermittent, weather-dependent output, creating a challenge for grid stability. This will only be exacerbated by the electrification of transportation – EVs will be 18% of the overall car market by the end of 2023, up from 4% in 2020 – and home energy, increasing the strain on the grid.

The easiest way to increase base and peak load capacity is storage. Gas is the heavy lifter here. Today more than 90% of the UK’s energy storage comes from gas; it’s relatively easy to store and we can turn plants on and off fairly easily, but it’s expensive and fossil-fuelled. We need greener, faster methods that can react to the immediate changes and needs of the grid.

This is where batteries come in. Battery energy storage systems allow power system operators and utilities to gather energy from the grid or a power plant and then discharge it at a later time when it’s needed, reacting to and smoothing demand-supply imbalances or grid outages in less than a second. Batteries are not the only new method of storage, but they are a key part of the market, expected to go through a 20x expansion by 2030, to 350GW of capacity.

One of the consequences of this transition, however, is an increase in the complexity of energy markets and the speed at which those markets change. Prices, for instance, will become more volatile, creating the opportunity for grid-scale battery operators to monetise their assets through pricing arbitrage, charging the batteries in periods of low demand and selling the energy at peak times. Market participants will need accurate, real-time data to monitor and get the most value from their assets.

A deep understanding

Meeting that need is Modo Energy, a software platform that provides data analytics to enhance the operation and financial planning of energy assets, with a focus on the battery energy storage market.

We discovered Modo Energy very early in its journey, alerted to the opportunity by our data-driven sourcing model, and stayed close with the company until the team was ready to raise. Now we’re delighted to be leading its $15m Series A, alongside existing investors Triple Point Ventures, Fred Olsen Limited, and Catalyst Capital.

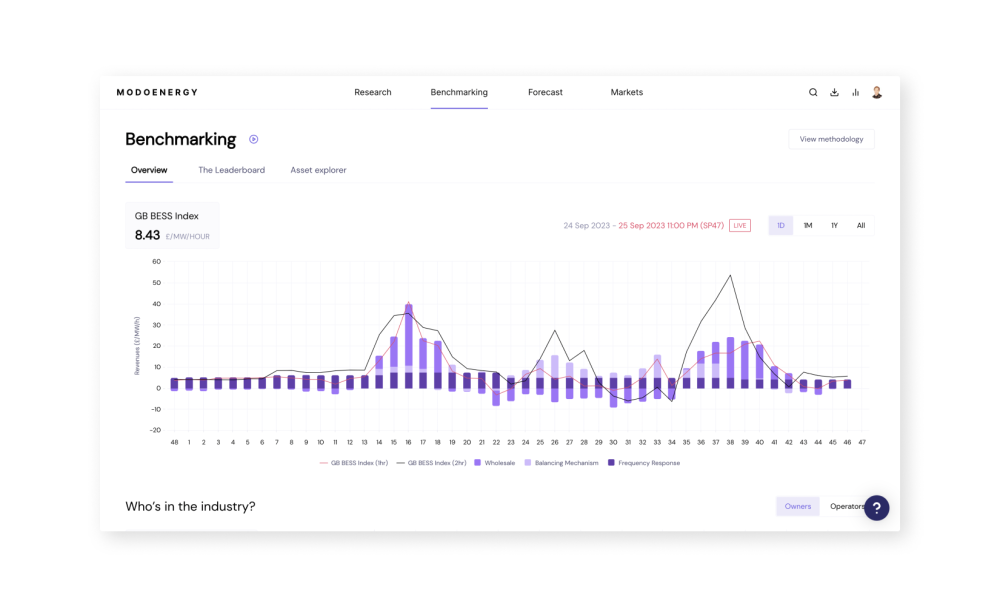

Founded in 2019 by Quentin Scrimshire (CEO) and Tim Overton (Director), Modo started as a small team in Birmingham before quickly emerging as the trusted authority in the UK’s rapidly growing battery storage market. Owners and operators representing approximately 90% of Britain’s grid-scale battery capacity rely on Modo’s platform for managing and optimising their assets. It offers revenue benchmarking, price forecasts, real-time data, and in-depth research, all in one place, and all designed to help monitor and optimise energy assets.

The two co-founders are natives of this market, Quentin previously head of energy storage at virtual power plant startup Kiwi Power, and Tim an engineering consultant at one of the world’s leading independent engineering consultancy firms for six years. They both bring deep expertise in energy storage, which is critical for navigating this highly technical, fast-evolving market. And their leadership and fast growth has established Modo as the place to go for talent in this space.

With this latest raise, the team’s attention has turned to global growth, and they are in pole position to own this space.

Transition creates opportunity

As the market for grid-scale battery storage grows – currently predicted to hit $16 billion by 2030 – there is a clear path to building a large, global business as the market matures and Modo’s customer base expands.

Coal, oil, gas and, more recently, wind and solar, have each gone through a long period of maturation where information sources, analytics, standards, and benchmarks emerged; and then those markets “financialised”, with the development of more investors, traders, consultants, and private equity backers. We expect the same thing will happen with the flexible energy market. Over the next 25 years there is expected to be $114tn investment in renewable infrastructure and assets, all of which will need to be rated, benchmarked, priced and researched, creating an enormous bond and derivatives market opportunity.

Modo is already building out its product to anticipate this need. Its recent product update, Modo 2.0, revolutionises the approach to revenue benchmarking and forecasting, offering users real-time data and autonomy over inputs and transparency of outputs, disrupting the legacy model of consultant-led, black-box forecasts. It makes this tooling invaluable to a broader set of market participants, including lenders (who typically finance such infrastructure projects), insurers, and investors – anyone who needs to understand what’s going on physically and financially with the grid and its assets.

And Modo’s expansion plans are as ambitious as their vision. The team has just opened their first US office in Austin, Texas, hoping to first crack the Texas and ERCOT market, followed by the rest of the US.

A natural fit

Our investment in Modo is a continuation of our commitment to support companies that use cutting edge data science and AI for industry-specific analytics. By way of example, in recent years I have led investments in AI-powered media and risk intelligence platform Signal AI, Senseye’s predictive maintenance for manufacturing equipment and Sky-Futures’ drone-based infrastructure monitoring.

And we apply this same lens to companies powering the transition to renewable energy, including Ogre’s AI energy management platform, Eatron’s battery management software for the automotive industry, and LiveEO’s AI-powered analytics of satellite earth observation data for monitoring energy assets. Modo Energy, with its mission to support a new electrified, flexible grid paradigm through the data layer, is a natural fit.

I’d like to credit my colleagues, Tom Scowsill and Lucci Levi, for their support and bringing their expertise to the process – Tom for his experience as a former Chief of Staff at Bulb Energy, and Lucci for her close collaboration with the Modo team on hiring.

This latest round will be instrumental in fueling Modo Energy’s expansion. It will enable the company to boost its product offering, building towards analytics, benchmarking, and predictive tools that allow renewable energy operators and investors to comprehensively track and index existing and emerging commercial opportunities in real-time, facilitating the clean energy revolution. Longer term, it puts them in a strong position to selectively target other forms of energy storage, and participate in new parts of the market as they develop, like vehicle-to-grid and the aggregation of home battery storage by utility companies.

Ultimately, Modo has the potential to become the Bloomberg terminal of energy – a common resource for every stakeholder in the flexible energy market. We’re excited to support Quentin, Tim and the rest of the Modo team’s ambition to shape a sustainable, efficient, and flexible energy future.