TreasurySpring has raised a $29m Series B. Ollie Richards, explains why we are excited to continue supporting the company on its growth journey

When we first met with Kevin, Mathew, James and the TreasurySpring team in early 2019, we were immediately impressed by the specialist cash management insights the team had. We were captivated by the founders’ ambitious vision and saw tremendous potential for their proposition within our portfolio (we have since helped turn over 20 of our portfolio companies into happy clients). This led us to invest in the companies Seed round and go on to co-lead the Series A. I highlighted our thinking for our initial investment at the time.

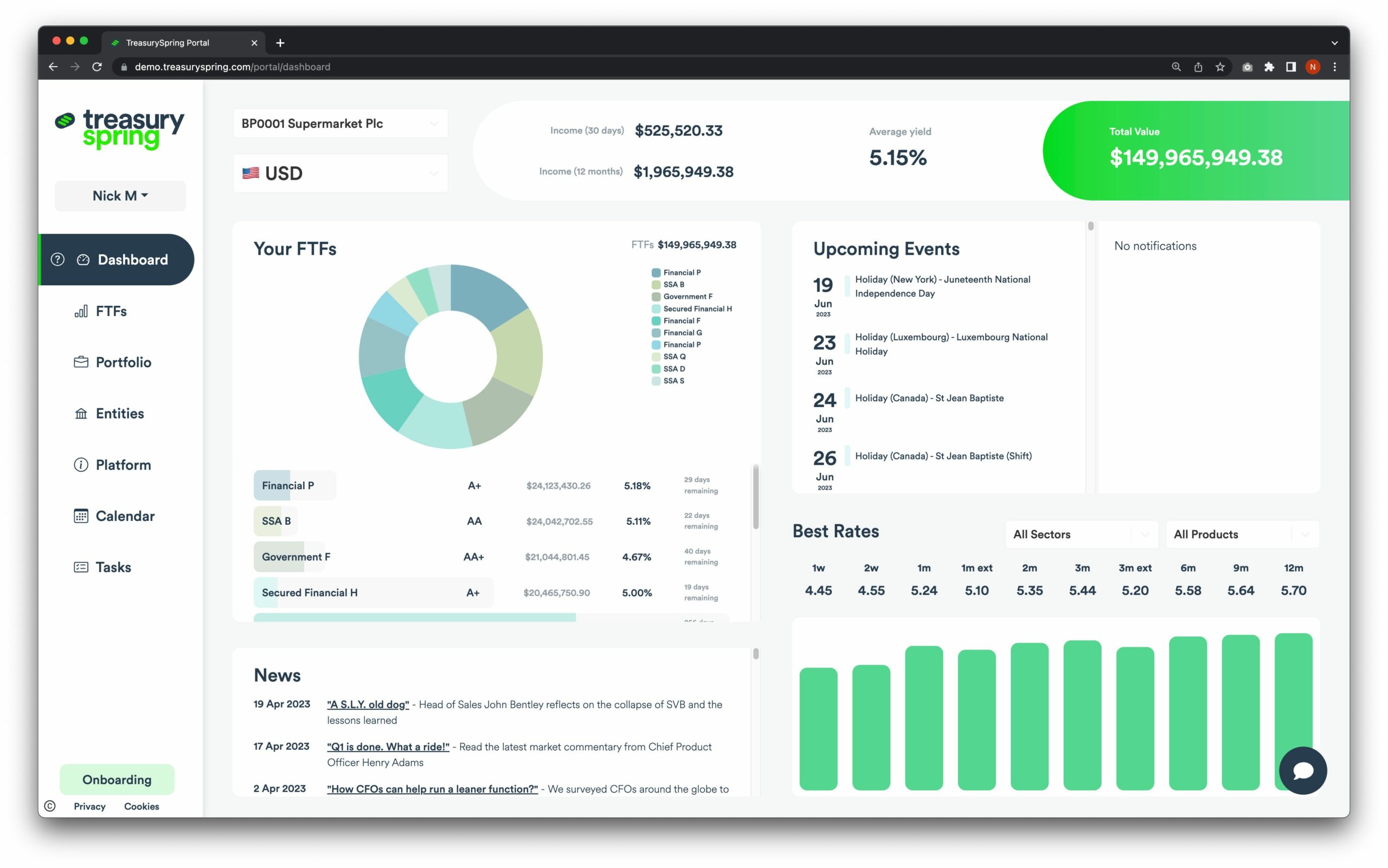

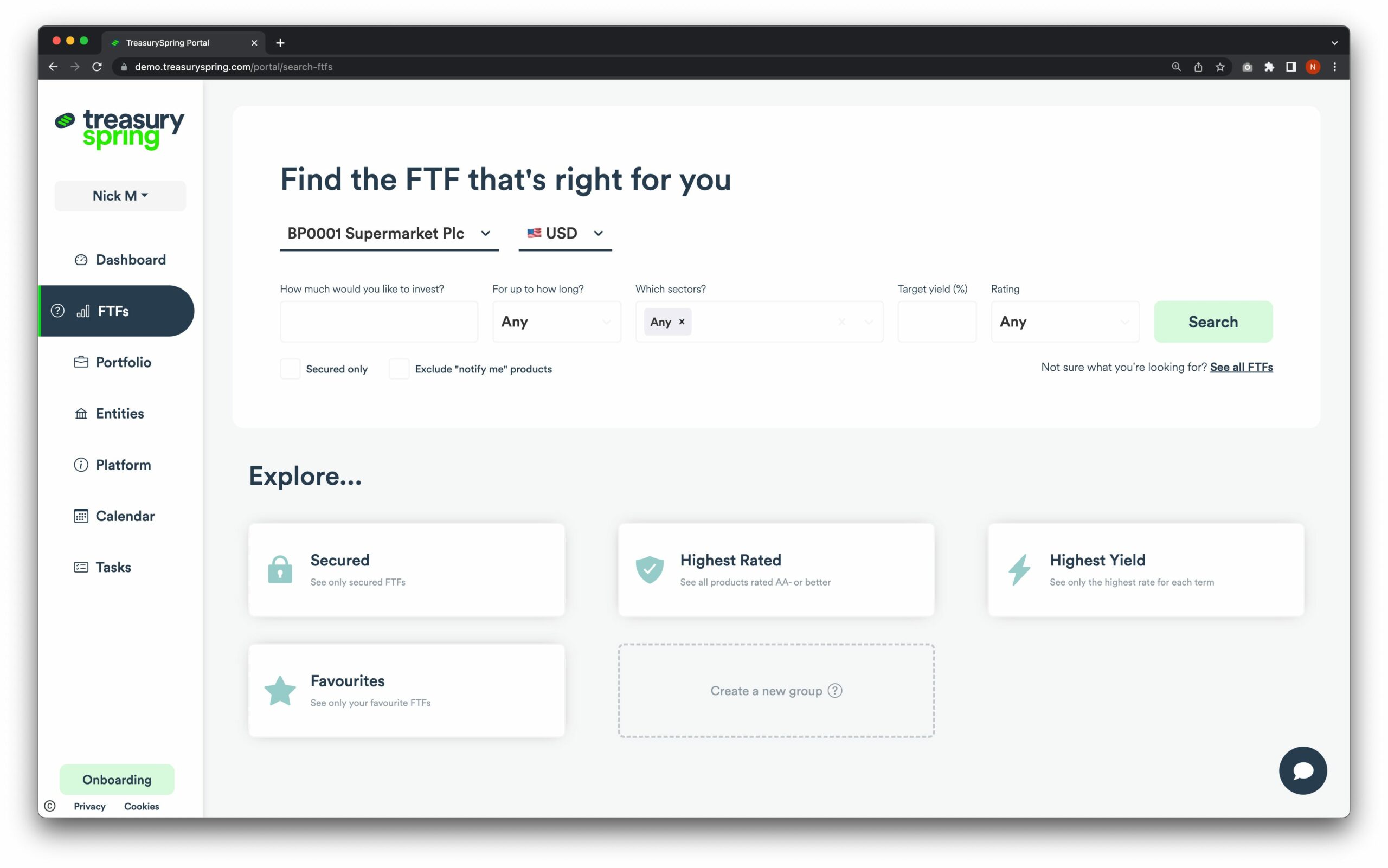

Since then, the appeal of Fixed-Term Funds (FTFs) as a secure, attractive investment product for our portfolio and the wider market of corporates with excess cash has become clear, along with some strong tailwinds having been created in the macro environment.

TreasurySpring positions itself today as a leading provider of cash management solutions that minimise risk through diversification, offer access to multiple investment options, collateralisation, and eliminate exposure to maturity mismatches.

When reflecting on the journey so far, one key insight from this Seed to Series B adventure is that you don’t have to hyper-scale the team to deliver rapid commercial growth. The team’s capital efficiency in scaling the business has been impressive. They have achieved remarkable growth while maintaining a relatively small team — a testament to the smart business model and their operational excellence.

Navigating Changing Market Dynamics

Since our initial investment, the market environment has undergone a significant transformation. Interest rates have shifted, opening people’s eyes to the possibility of generating yield from large cash balances. We have witnessed this unexpected new revenue across our portfolio companies that have invested in FTFs through TreasurySpring. This macro shift has resulted in implications across the fintech sector, particularly for banks and wealth tech firms, which benefit from a higher rate environment.

The SVB Wake-Up Call

The recent collapse of SVB highlighted the importance of treasury management to all businesses, and in particular, the early-stage venture capital ecosystem. Since SVB, we, along with our peers, have proactively advocated for prudent cash management among founders and on the boards we have the privilege of working with. I am hopeful that the recent learnings in this area will help inform founders for many years to come.

MMC published some best practices (linked below), and Kevin’s recent blog (also linked below) sheds light on the lessons learned from SVB. Among them are the significance of diversification across client bases and funding sources and the risks associated with maturity transformation and liquidity mismatches. Regulations and predictive models underestimated the potential liquidity needs in a bank run and certainly in the small VC-backed cohort of companies that exhibited herd-like behaviour in fund withdrawals.

Collective Action and Swift Resolutions

Almost immediately after the desperate cash calling, it was great to see the European VC and start-up community rally together over the weekend of carnage and effectively push for swift action from politicians to resolve what could have become a systemic problem. The coordinated efforts displayed the resilience and determination of the community to tackle challenges head-on made me proud of our ecosystem and to play a small part in advocating for a solution.

Big Plans

The next few years hold immense opportunities for TreasurySpring’s further growth and development. The company has plans for geographic expansion, continued product evolution, and significant initiatives to drive broader adoption of FTFs.

I’m delighted to welcome Rana and Rob from Balderton along with Mubadala Capital on this journey as part of the company’s most recent funding round, and I’m excited to see what the TreasurySpring team can achieve from here.

As part of our career development planning at MMC, we encourage secondments within our portfolio companies. It’s great to have Masamba, one of our investment team members, currently on secondment at TreasurySpring. He’s playing a part in actively driving forward key initiatives and contributing to the company’s ongoing success.

Fantastic TreasurySpring Future

I believe the future shines brightly for TreasurySpring and FTFs, and we are excited to witness the next phase of its remarkable journey. With a strong foundation and product, an expert team and a range of exciting growth opportunities to pursue.

I’m looking forward to the next phase!

If you’re an entrepreneur building something in B2B software, please reach out. We love learning about new ideas — ollie@mmc.vc

Follow Ollie on LinkedIn