As MMC announces leading the Sano Genetics Series A, I wanted to share my thoughts on why we’re excited by the future of the business.

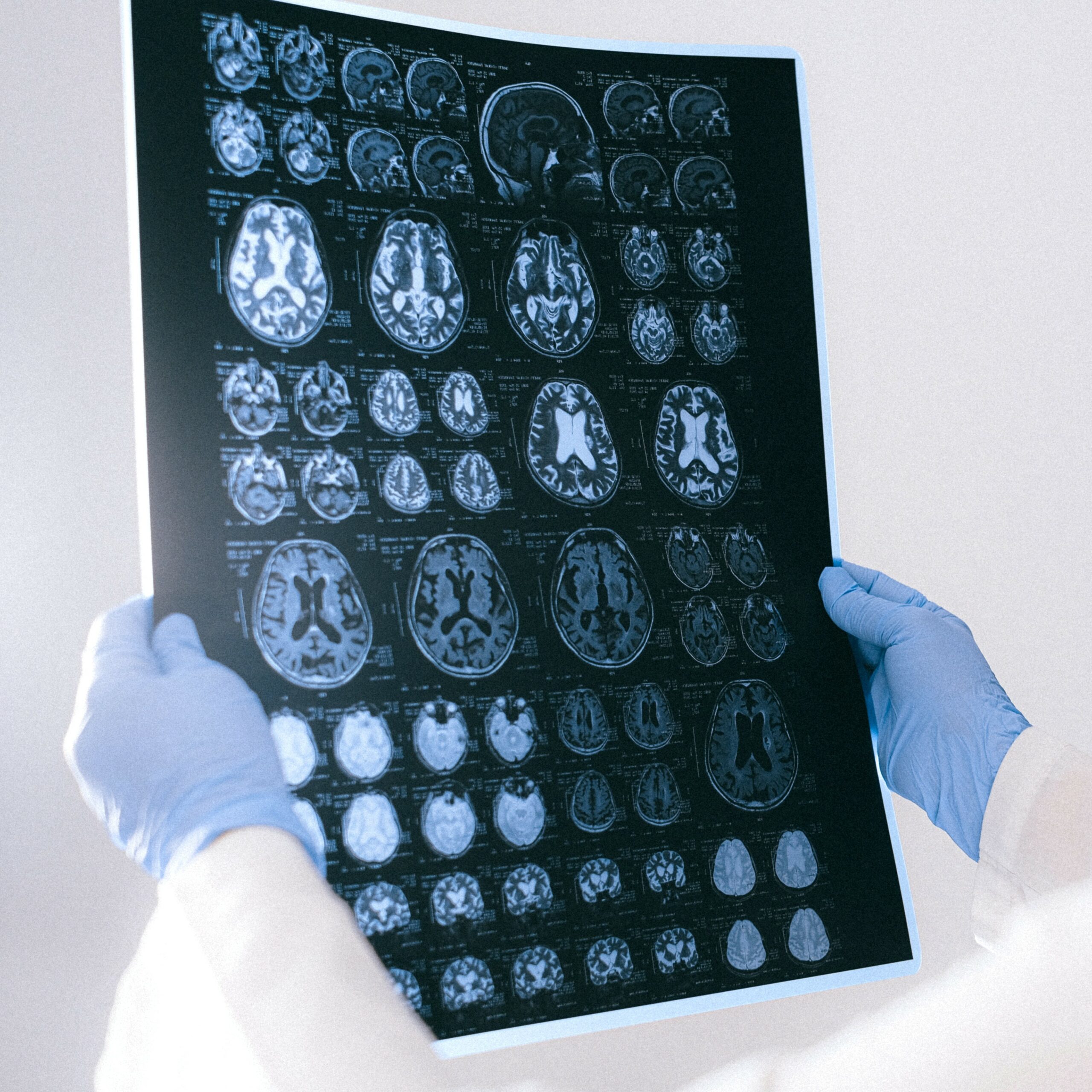

We identified clinical trial technology as an attractive investment area based on our thesis surrounding the rise of decentralised trials, accelerated by COVID-19, and the data underpinning them. We saw the urgent need for infrastructure to support bottlenecks in clinical operations, such as patient recruitment, and break down legacy data silos within healthcare systems to promote collaboration, which is fundamental if personalised medicine is to be successful.

From the get-go, we were impressed by the team’s on-point approach and unwavering purpose-led strategy to promote access, and the success of, personalised medicine with data governance at the forefront. Sano’s vision is to become the operating system for the delivery of personalised medicine, promoting the discovery of new treatments by connecting pre-existing genetic datasets and building proprietary, high-quality new ones. Their approach is underpinned by an end-to-end software platform, which allows them to interact directly with patients, biotech and patient communities to solve the most significant problem in clinical trials, patient recruitment and engagement, particularly pronounced in gene therapy trials.

MMC is thrilled to have led Sano’s $11m series A round. We wanted to share why we are excited to join Sano’s journey to become a category-defining business driving the personalised medicine agenda.

Patient recruitment in personalised medicine

The clinical trial setup has not changed since the 1980s, since the era of the “blockbuster drug” where patients were recruited with brute force to get statistical significance for market approval. This market was dominated by Big Pharma, which had the funds to bankroll this approach and outsourced the entire process to Contract research organisations (“CROs”).

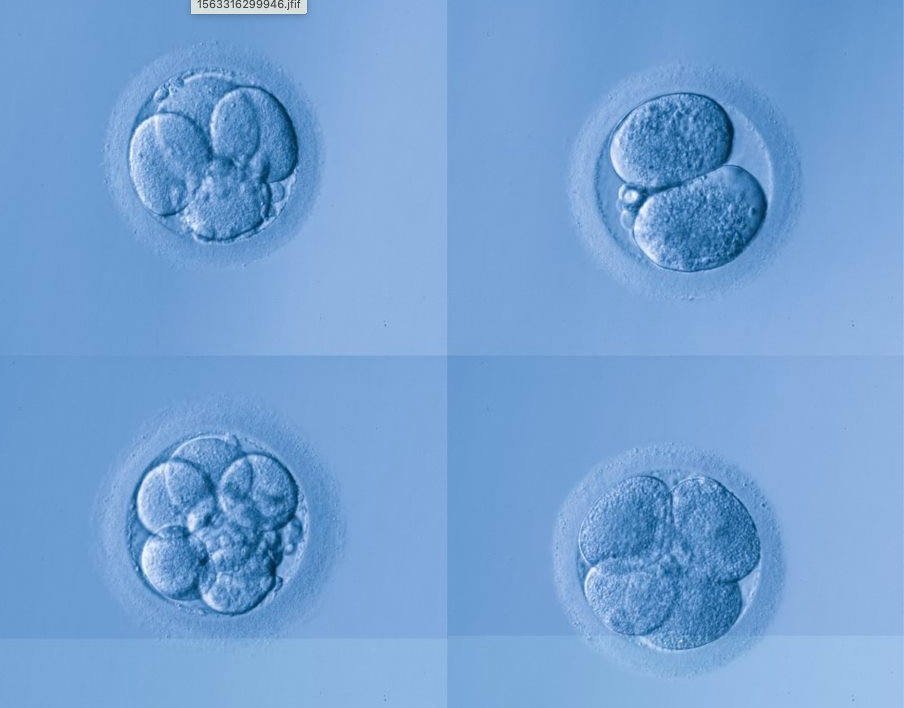

Over the past ten years, there has been a monumental shift in our ability to collect and analyse genomic data due to continued innovation and reduced DNA sequencing costs. This has increased the feasibility of personalised medicine, where groups of people are targeted with medical inventions and treatments based on their DNA. The benefit of personalised medicine is universally seen by all stakeholders: improving drug efficacy for Pharma and getting appropriate therapies into the hands of patients quicker and cost-effectively. Given this potential, technological innovation in genetic sequencing is driving ~22% growth in gene and cell therapy clinical trials, which is expected to reach $45Bn by 2028.

By the nature of personalised medicine, finding patients is complex, with very selective inclusion/exclusion criteria to enrol participants into trials. The CROs have a cost-plus model where they rely on bricks-and-mortar sites for patient recruitment, which often do not have the infrastructure or patient access. This is particularly hard given the fragmentation of genomic data across government, academia, consumer platforms and healthcare providers, many of which do not meet the high quality of information required for gene therapy trials. This combination results in significant time and cost inefficiencies and a high failure rate for patient enrolment.

There has been an increase in smaller biotechnology companies driving innovation in gene therapy that do not have the same multi-billion dollar budgets as big Pharma. As such, 80% of clinical trials are delayed costing $600k-$8m per day per drug, making clinical trials more expensive for large Pharma and economically unfeasible for small/medium biotech.

With this backdrop, the clinical trial model needs to change. New infrastructure is required to support the highly complex logistics that make up the clinical trial operations for gene therapy trials and personalised medicine.

Decentralised trials, data requirements and new clinical operating models

Patient recruitment is a valuable and highly complex problem, so several startups have targeted this market. At MMC, we have considered what it means for a business to succeed in space and why now is the right time to invest.

Through our research, the following themes stood out, which have underpinned our thesis in the space:

- The term “decentralised trials”, meaning that participants can be screened and monitored for trials remotely, has been a buzzword for several years with the rise of telemedicine and remote patient monitoring. However, COVID-19 has meant that clinical trial recruitment through physical sites was nearly impossible. This has resulted in an increased uptake in Pharma choosing providers who can facilitate decentralised trials. This has also made trials more accessible for small to medium biotech as a more cost-effective option.

- Big Pharma is exploring alternative models looking at its tech and vendor stack for more effective clinical operations. They are open to working with best of breed partners alongside existing CRO partners.

- It is not a “one player takes all” in patient recruitment. Pharma and biotech work with many sources of patient data today (with smaller biotech leading the charge on innovative patient recruitment strategies) from academia, government groups and biobanks, and physical sites and healthcare providers.

- Historically, patient recruitment has been highly transactional, leading to low patient engagement and mistrust. Pharma is looking for a framework to help them develop longer-standing relationships with trial participants for follow-up studies promoting better engagement driving a higher quality of clinical data.

- Genetic information on patients is critical as an objective biomarker for clinical trials; however, real-world evidence and disease presentation is vital information to sit alongside. Therefore both are needed to add maximum value to the trial.

Sano as an operating model

Sano has developed a platform that enables them to match, engage and build long-lasting relationships with trial participants, biobanks and Pharma for personalised medicine trials. Their unique approach seamlessly brings together pools of fragmented pre-existing, high-quality genetic profiles through partnerships, which is combined and enhanced through their in-house, “at-home” genetic testing capability. Their approach is underpinned by proprietary, modular enterprise software and an excellent participant experience, which connects all stakeholders, promoting dynamic consent, ongoing engagement and empowering trial participants to take control of their genetic data.

This patient-centric approach has been fundamental in enabling them to build trust and embedded relationships with Pharma, biotech and data partners to become the “hub” or operating system by which the market comes together. Their 360-degree market focus promotes ongoing engagement with their genetic database of over 1.3 million patient profiles, enabling them to recruit patients for gene therapy trials 10x faster and 5x cheaper than incumbents. For this reason, Sano’s proposition is compelling to Pharma driving solid relationships and providing future opportunities for follow up trials within the same drug and across their portfolio.

Scaling for the future

Sano is already an international business selling to customers in the US, UK, Australia and currently expanding to the Netherlands. This is just the start. Pharma customers understand the need for a global presence to avoid “batch effects” within their patient groups which means Sano will continue to expand globally with their customers.

The platform’s scale is essential to becoming the de-facto platform for Sano’s customers. Through a flywheel effect, Sano will grow the genetic database at an increasing pace as they take on more studies, allowing them to expand their disease coverage and deliver exponential value to their customer base in a capital-efficient manner. Within two years, they are looking to expand to over 3 million high-quality genetic profiles (c.25% of 23andMe’s database at the point of IPO).

Sano’s vision is to deliver personalised medicine to billions of people based on genomic and medical data. This will allow Sano to become the platform for the entire life cycle of personalised medicine development, from early-stage drug discovery to clinical research and deployment in the real world.

Founder — market fit with deep expertise working in genomics

Sano was founded by Patrick, Charlotte and Will, who met during their PHDs at Cambridge and later worked together at the Wellcome Sanger Institute, a world leader in genomic research. The founders saw first-hand the difficulty of finding patients with specific, enriched genetic biomarkers. They have a deep understanding of the problem. They are ambitious and purpose-driven, with patients front of mind to provide them with better access to personalised medicine. The combination has allowed them to quickly build credibility and trust with their customers and partners, which came across strongly during our diligence.

The founders have built a strong team of over 20, including an impressive senior leadership team who bring technical and commercial experience from firms such as hVIVO, Push Doctor, GSK, Hello Fresh and others. Our investment will help significantly expand the team supported by the strong foundations built, and we can’t wait to see what they will do next!