MultiOmic Health, an artificial intelligence (AI)-enabled drug discovery company, has closed a £5 million (US$6.2 million) seed funding extension round to build its precision therapeutics discovery platform for metabolic syndrome-related medical conditions.

MMC was proud to participate in the round, alongside Hoxton Ventures, Ada Ventures, and Verve Ventures.

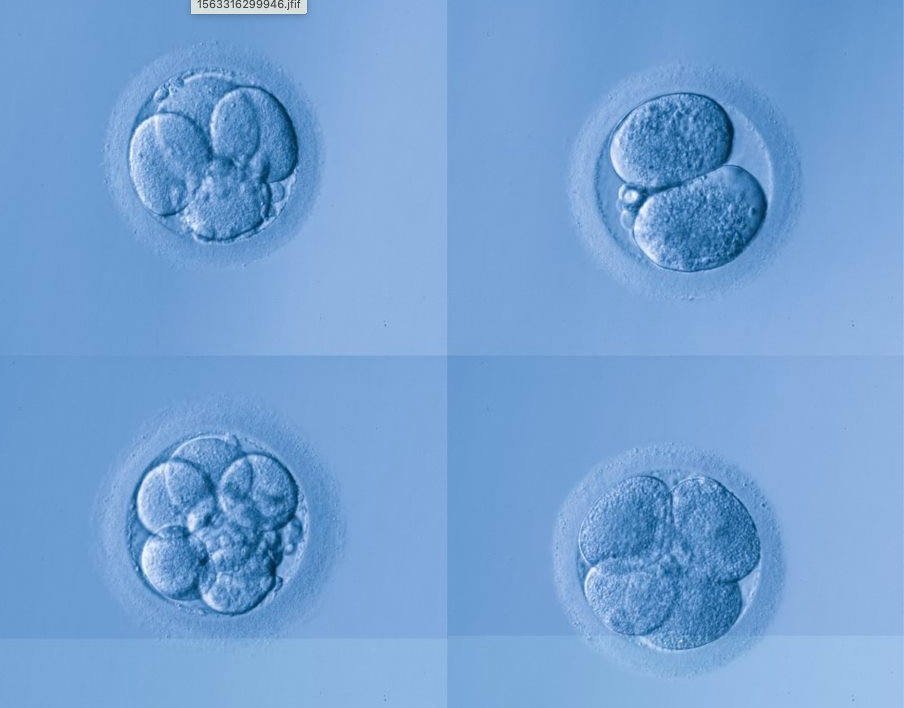

Existing treatments for metabolic syndrome-related conditions merely reduce risk or delay onset of serious consequences such as heart attack, stroke, kidney failure, blindness, nerve damage, foot amputation, liver failure and premature death. Patients’ disease journeys exhibit immense heterogeneity, reflecting potentially hundreds of different disease variants that result not only from inherited genetics, but also diet, lifestyle and other environmental factors. Unlike cancer however, there are no existing precision medicines to tackle the specific molecular-level drivers of each metabolic syndrome disease variant.

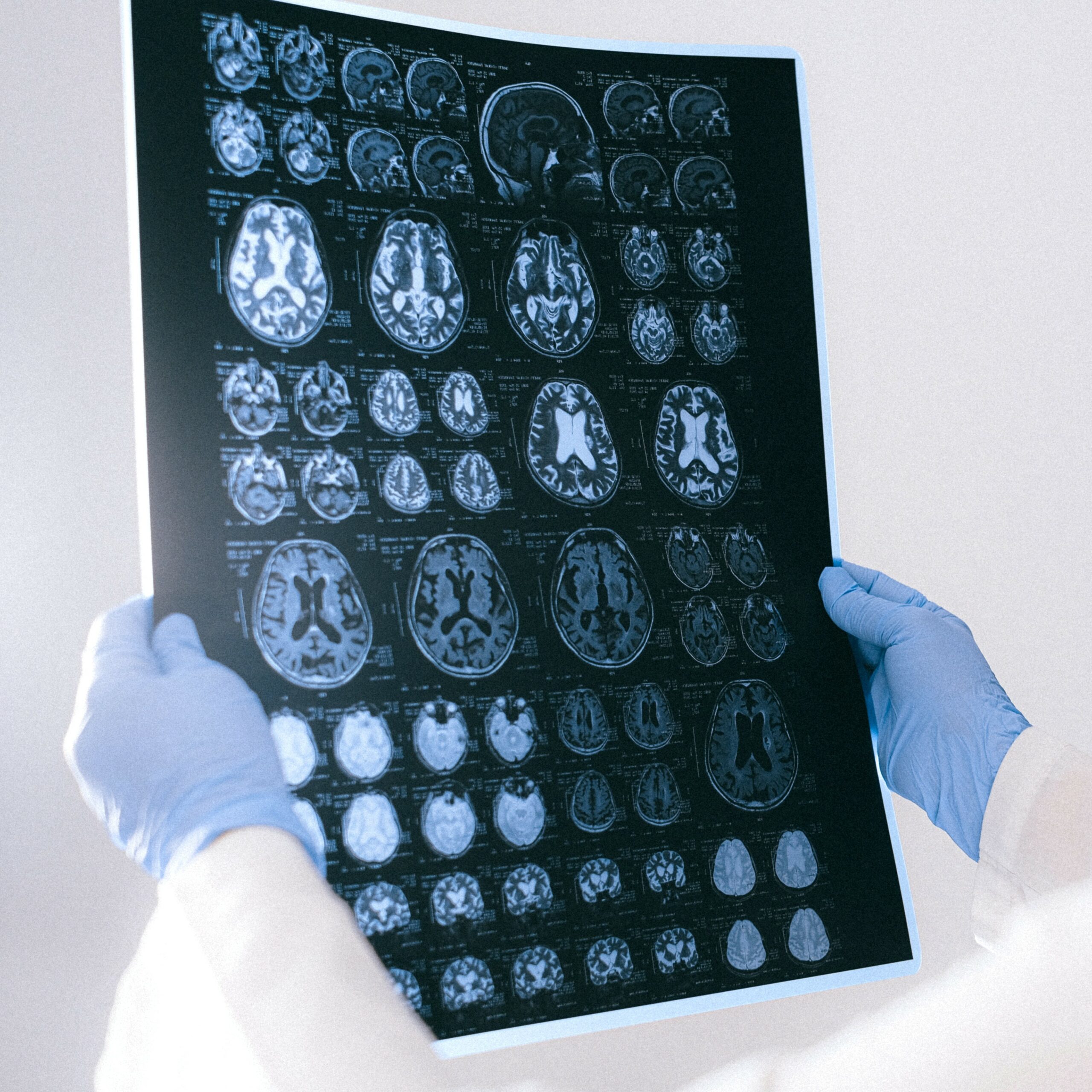

The proceeds of the financing round will be used to demonstrate proof-of-concept for MultiOmic’s MOHSAIC® platform, which combines :

- Machine learning and other AI techniques to analyse complex multi-omics patient data and corresponding longitudinal clinical information;

- Systems biology simulations of disease pathways; and

- Iterative refinement and validation of in silico findings using targeted wet lab experiments.

For more on MultiOmic Health’s funding round, see media coverage by Silicon Canals and FinSMEs.